As 2023 Nears, What Is the Status of 5G and What Can We Expect From 6G in the Future?

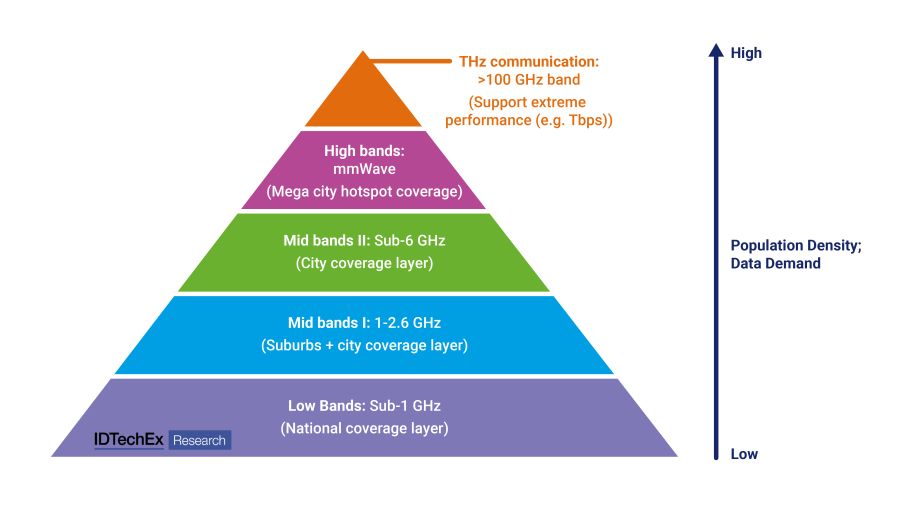

Adding a new spectrum is key to each new generation of telecommunications. The two new frequency bands in 5G are sub-6 GHz (3.5 - 7 GHz) and mmWave (24 – 71 GHz). The initial wave of 6G development looks at expanding the spectrum to the THz area, with a special focus on the sub-THz range (100 - 300 GHz).

The advantages of going up to a higher frequency band are obvious: substantial bandwidth (translating to large data throughput) and extremely low latency. These two key benefits allow the exploration of new applications that past generations of telecommunications were unable to explore. Nonetheless, severe signal attenuation when encountering obstacles, such as raindrops or walls, is a crucial bottleneck in the high frequency spectrum.

Deployment Strategy

The characteristics of different frequency bands will lead to drastically different deployment strategies. As shown in Figure One, the foundation of mobile networks will still be based on low and mid bands I. On the other hand, higher bands will be deployed in regions with high population densities. For instance, the Sub-6 GHz band is largely deployed for cities, whereas the majority of mmWave deployment is limited to population-dense venues such as stadiums and metro stations.

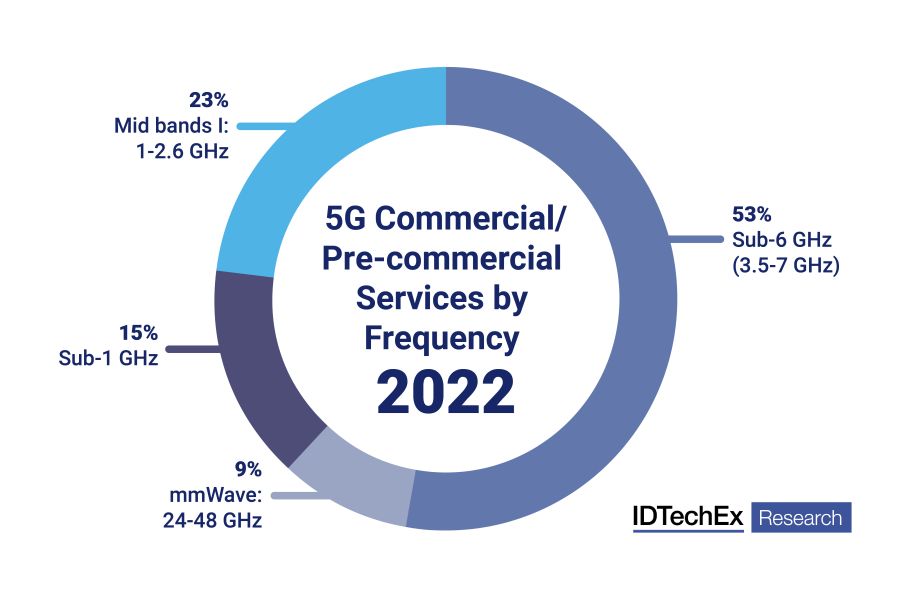

IDTechEx has examined the global 5G commercial and precommercial services by frequency, as shown in Figure Two. According to their findings, sub-6 GHz frequency bands dominate more than 50% of 5G services. Another 38% is based on the low and mid bands I, while mmWave accounts for just 9%. Sub-6 GHz frequency ranges are more desirable for deployment for 1) a better balance of coverage and capacity and 2) proximity to 4G frequency bands. It is not surprising that mmWave accounts for only 10% of the global 5G service deployment, given how economically unviable it would be to deploy mmWave at a large scale for public networks.

IDTechEx has examined the global 5G commercial and precommercial services by frequency, as shown in Figure Two. According to their findings, sub-6 GHz frequency bands dominate more than 50% of 5G services. Another 38% is based on the low and mid bands I, while mmWave accounts for just 9%. Sub-6 GHz frequency ranges are more desirable for deployment for 1) a better balance of coverage and capacity and 2) proximity to 4G frequency bands. It is not surprising that mmWave accounts for only 10% of the global 5G service deployment, given how economically unviable it would be to deploy mmWave at a large scale for public networks.

What Is the Global 5G Deployment Status in 2022?

What Is the Global 5G Deployment Status in 2022?

5G is recognized as an important infrastructure for both developed and developing countries. As of September 2022, 98 nations have commercialized 5G or are conducting 5G trials, compared to 79 at the end of 2021. The majority of countries deploy 5G sub-6 GHz frequency bands, and only a few countries, including the US, South Korea, Japan, Italy, Australia, South Africa, etc., have commercialized 5G mmWave.

In their latest 5G research market report, “5G Market 2023-2033: Technology, Trends, Forecasts, Players”, IDTechEx specifically looks into the deployment strategy of 5 key regions: the US, China, Europe, Japan, and South Korea. For each region, government and telecom operator strategies for 5G rollout are focussed on. The following paragraph shows a high-level review of the deployment status in the United States.

US:

Government Side:

· Spectrum strategy: The US is one of the earliest countries that released the mmWave spectrum. When all the other pioneering countries, such as China and South Korea, are focusing on sub-6 GHz development, the FCC (Federal Communications Commission) in the US didn’t release a sub-6 GHz frequency band until early 2021. This has resulted in slow sub-6 development in the US.

· US sanctions: In 2019, the sanctions on Chinese equipment and devices considered endangering national security first took effect. Since then, attempts to tear and replace that equipment (for example, Huawei’s 5G radios) have continued. To accelerate the process, the government supports small-scale operators with funds to do so. The sanctions are unlikely to be lifted anytime soon. Instead, the US broaden the restrictions to include Silicon, the core of telecom infrastructure. On October 7, 2022, the United States announced a series of targeted updates to its export regulations concerning semiconductors and associated technologies with respect to China (see our article “Impact of Newly Added US Sanctions on the Chinese Semiconductor Sector” for more details). This action will compel Chinese vendors to continue supplying cutting-edge communications radios.

· Open RAN: Given the lack of dominant US-based 5G telecom equipment suppliers, the FCC has supported Open RAN development.

Telecom Operator Side:

One of the biggest US telecommunication operators, Verizon, had previously invested in mmWave deployment. Verizon's mmWave rollout is largely targeted toward crowded spaces like stadiums. Nevertheless, when the sub-6 GHz spectrum acquisition was finished, Verizon's 5G development shifted its attention (if not completely) to sub-6 GHz. AT&T, one of Verizon’s largest competitors, took a similar path. On the other hand, T-Mobile started by giving low and mid-band expansion priority. Due to its acquisition of Sprint, T-Mobile currently offers the most comprehensive mid-band coverage (using 2.5 GHz). Even though T-Mobile also bought a license for the sub-6 GHz frequency (3.7-3.98 GHz), the spectrum won't be usable until about 2023.

What Is the Important Technical Development/Trend in 5G Now and the Future 6G?

Though 5G is commercialized, there is still a lot of ongoing technical development. In addition, 6G research has already started. In this article, IDTechEx discusses the five key points regarding technical development in 5G and 6G:

Power Management for Sub-6 GHz MIMO Radio:

Power amplifiers consume around 80% of the power in a transceiver; hence power management for telecommunication radios has long been focused on them. Many approaches have been used to reduce a radio's power consumption, including using high-efficiency power amplifiers and introducing software that can put analog components to sleep when there are no loadings. However, further efforts are required since computation needs rise significantly in 5G and beyond radios, and the power consumption of digital components plays a vital role that should not be overlooked. Si technology enables digital components. The performance of Si will significantly impact the fundamental characteristics of a radio, such as connectivity, capacity, power consumption, product size, weight, and, ultimately, cost. All of these are crucial elements in a 5G system. In IDTechEx’s “5G Market 2023-2033: Technology, Trends, Forecasts, Players” report, a comprehensive analysis of power management for 5G radios, Si industry, and its impact on 5G development are provided. IDTechEx also has a dedicated report on advanced semiconductor packaging that is key to next-generation ICs.

Smart Electromagnetic Environment and Small Cell Deployment

Despite that 5G mmWave is an appealing spectrum for its large bandwidth capacity, mmWave signals have lower coverage than sub-6 GHz because of increased path loss and more vulnerability to obstructions in the propagation environment. High EIRP (Effective, or Equivalent, Isotropically Radiated Power) systems would be necessary for mmWave applications. However, this technique has several drawbacks, including greater costs and power supplies.

To find a balance, the market is now evaluating several trade-off choices in relation to network performance, network complexity, installation costs, and electromagnetic field (EMF) levels. To achieve homogeneous coverage for the radio access network without necessarily installing additional macro-sites, installing new types of network nodes would need to be much less expensive and easier to install than conventional Macro and Micro BSs.

Small cells and reconfigurable intelligent surfaces (RIS) are two key types proposed to address the challenge of short signal propagation range caused by high frequency. Deploying more small cells complements the macro network and therefore boosts data capacity. RIS (in a semi-passive mode) is a very low-power device capable of overcoming connection blockages. In IDTechEx’s “5G Market 2023-2033: Technology, Trends, Forecasts, Players” report, a comprehensive analysis of RIS technology and its use cases are provided. IDTechEx’s “5G Small Cells 2021-2031: Technologies, Markets, Forecast” report provides more details regarding small cell technology trends and use cases.

Open RAN Development

The 5G open radio access network (Open RAN) is gaining popularity. Open RAN is a network alternative to traditional legacy RAN that allows interoperable components (including hardware and software) from many suppliers to function smoothly together. It is intended to abolish the radio access network (RAN) system's proprietary character, diversify the vendor supply chain in the telecom sector, stimulate more innovation, and minimize RAN implementation's upfront and operating costs. As of September 2022, NTT DOCOMO had built the first 5G Open RAN networks, with many additional telecom operators planning to launch 5G networks utilizing Open RAN technology soon. However, numerous obstacles must be addressed, including the delayed growth of RIC and interoperability concerns.

How would Open RAN disrupt the 5G infrastructure market and influence supply chain dynamics? Who are the players in the Open RAN field? What would be the potential Open RAN business model? What are legacy system vendors’ (Huawei, Ericsson, Nokia) attitudes and strategies towards Open RAN? What are the remaining challenges of Open RAN? IDTechEx, in their newly released “5G Market 2023-2033: Technology, Trends, Forecasts, Players” report, explores deeply into this topic that will help you understand the future trend of the 5G infrastructure market.

mmWave Development

The development of mmWave has yet to take off. One of the most significant impediments for mmWave is a lack of killer applications. The sub-6 GHz spectrum can comfortably handle many applications. The motivation to migrate to mmWave is weak. Fixed wireless access applications are now the most promising use of mmWave, and the technology is gaining popularity in places where fiber rollout is limited.

In terms of technological problems, beamforming IC development, low-loss materials with low dielectric constant and tan loss, and new packaging technologies are particularly important. Because of the short wavelength of mmWave communications, devices are getting smaller and more integrated to avoid excessive transmission loss between antenna and RF components, demanding additional power and thermal management. IDTechEx evaluates technical pain points and investigates trends and innovations for 5G materials and design in our 5G offering (“5G Market 2023-2033: Technology, Trends, Forecasts, Players”, “Low-loss Materials for 5G 2021-2031” and “Thermal Management for 5G 2022-2032”).

6G Development

6G research began as early as 2017. The spectrum for the first wave of 6G deployment will be concentrated on the sub-THz band (100 – 300 GHz). New materials and integration methodologies for radios will be necessary as the spectrum moves up into the THz region. Semiconductor selection is one of the most significant (if not the most important) aspects of 6G. Si-based power amplifier technology is widely used in mmWave applications. However, it will be unable to handle the link budget required in 6G when the frequency rises to THz. Then III-V compounds come into the equation, but integration with Si digital components becomes difficult. Despite the technological obstacles, 6G will enable many applications outside mobile networks, such as accurate positioning, sensing, imaging, and so on. IDTechEx assesses technical developments and investigates trends and innovations for 6G materials and design in our 6G offering (“6G Communications Market, Devices, Materials 2021-2041” – update coming December 2022).

Outlook for 2023 and Beyond?

The 5G market is booming. According to IDTechEx, consumer mobile services will produce US$850 billion in revenue by the end of 2033, while 5G macro infrastructure sectors will increase eightfold in 2020. Other important points are as follows:

- For many years to come, sub-6 GHz will be the main frequency for deployment, whereas mmWave will require further technological advancement and killer applications to gain the market, which will take years.

- The political turmoil, as well as the development of Open RAN, will have an impact on the 5G system's player dynamics.

- Si is critical to the advancement of 5G since its performance substantially impacts connection speed, capacity, power consumption, product size and weight, and, ultimately, the cost of a 5G system.

- Small cells and reconfigurable intelligent surfaces will play a critical role in enabling 5G mmWave and beyond network development.

- The mmWave research and development trend focuses on beamforming technology, low-loss materials, power and thermal management, and advanced semiconductor packaging. The 6G research and development trends focus on choices of semiconductors, metamaterials, novel designs for THz communication systems, and heterogeneous integration.

For further understanding of the overall 5G markets, players, technologies, opportunities, and challenges, please refer to the IDTechEx report “5G Market 2023-2033: Technology, Trends, Forecasts, Players”. In addition, IDTechEx has also authorized several market research reports that cover critical 5G technologies in-depth, including “5G Small Cells 2021-2031: Technologies, Markets, Forecast”, “Low-loss Materials for 5G 2021-2031” and “Thermal Management for 5G 2022-2032”. To learn more about 6G, please refer to the IDTechEx 6G report - “6G Communications Market, Devices, Materials 2021-2041” (update coming December 2022).

Visit www.IDTechEx.com/Research/5G for more information.

SOURCE: IDTechEx, Cambridge, UK